After introducing the general idea of stochastic clocks in the previous post, we now consider the case where the instantaneous rate of activity follows a non-Gaussian Ornstein-Uhlenbeck process. The major reference is the paper by Barndorff-Nielsen and Shephard (2001b), see also Barndorff-Nielsen and Shephard (2001a). In this post, we discuss the general stochastic setup that applies to all such models that are driven by an almost surely non-decreasing Lévy processes. For the moment, we leave the particular dynamics of this subordinator unspecified but we will provide examples in future posts.

Related Posts

- General Stochastic Clocks

- Gamma Ornstein-Uhlenbeck Stochastic Clocks

- Cox-Ingersoll-Ross Stochastic Clocks

- Inverse Gaussian Ornstein-Uhlenbeck Stochastic Clocks

Subordinator Lévy Processes

We start by giving the conditions for a Lévy process to be a subordinator. Let ![]() be a one-dimensional Lévy processes process with characteristic triplet

be a one-dimensional Lévy processes process with characteristic triplet ![]() . Here, the Radon measure

. Here, the Radon measure ![]() on

on ![]() satisfies

satisfies

![]()

such that the Lévy-Itō decomposition exists, see e.g. Proposition 3.7 in Cont and Tankov (2004). As usual, the characteristic triplet is given w.r.t. the truncation function ![]() . We recall the conditions that the Lévy triplet has to satisfy such that the paths of

. We recall the conditions that the Lévy triplet has to satisfy such that the paths of ![]() are almost surely non-decreasing. First, for the paths to be of finite variation, they cannot have a Gaussian component, i.e.

are almost surely non-decreasing. First, for the paths to be of finite variation, they cannot have a Gaussian component, i.e. ![]() , and

, and

![]()

see e.g. Theorem 21.9 in Sato (1999) or Proposition 3.9 in Cont and Tankov (2004). Second, the jumps of ![]() need to be non-negative and thus

need to be non-negative and thus

![]()

Consequently, the Lévy measure satisfies

![]()

Now let ![]() be a Poisson random measure with intensity measure

be a Poisson random measure with intensity measure ![]() . Due to the above conditions imposed on the Lévy measure, it is not necessary to compensate for the small jumps and the Lévy-Itō decomposition simplifies to

. Due to the above conditions imposed on the Lévy measure, it is not necessary to compensate for the small jumps and the Lévy-Itō decomposition simplifies to

![]()

Non-Gaussian Ornstein-Uhlenbeck Process

The instantaneous rate of activity process ![]() follows a non-Gaussian Ornstein-Uhlenbeck process. It has the dynamics

follows a non-Gaussian Ornstein-Uhlenbeck process. It has the dynamics

(1) ![]()

subject to ![]() and where

and where ![]() . Here

. Here ![]() is a subordinator Lévy process as defined in the previous section. It is often referred to as the background driving Lévy process. The definition of

is a subordinator Lévy process as defined in the previous section. It is often referred to as the background driving Lévy process. The definition of ![]() given here is in accordance with the one in Barndorff-Nielsen and Shephard (2001b).

given here is in accordance with the one in Barndorff-Nielsen and Shephard (2001b).

Due to the ![]() having almost surely non-negative increments, it follows that

having almost surely non-negative increments, it follows that ![]() is strictly positive. To get some intuition for its paths, assume for the moment that

is strictly positive. To get some intuition for its paths, assume for the moment that ![]() follows a compound Poisson process with non-negative jumps. Then the paths of

follows a compound Poisson process with non-negative jumps. Then the paths of ![]() are piecewise constant. Now let

are piecewise constant. Now let ![]() be such that

be such that ![]() is a jump time of

is a jump time of ![]() , then

, then ![]() . Inbetween two jumps,

. Inbetween two jumps, ![]() is piecewiese constant and thus

is piecewiese constant and thus ![]() is piecewise continuous. It exponentially decays at the rate

is piecewise continuous. It exponentially decays at the rate ![]() .

.

This general setup encompasses various special cases that have been examined in the literature, such as the gamma and the inverse Gaussian Ornstein-Uhlenbeck processes. These names are not based on, as one might first suspect, the type of process followed by ![]() but instead on the stationary distribution of

but instead on the stationary distribution of ![]() . We analyze these two special cases in later posts. To find the solution to Equation (1), we first find the dynamics of

. We analyze these two special cases in later posts. To find the solution to Equation (1), we first find the dynamics of ![]() to be

to be

![]()

and then integrate both sides to obtain

![]()

It is convenient to make a change of variables by setting ![]() such that

such that

![]()

The total activity process ![]() is then defined as

is then defined as

![]()

Characteristic Function

We are now interested in finding the characteristic function ![]() of

of ![]() . By definition

. By definition

![Rendered by QuickLaTeX.com \begin{align*} \phi_{Y_t}(\omega) & = \mathbb{E} \left[ e^{\mathrm{i} \omega Y_t} \right]\\ & = \mathbb{E} \left[ \exp \left\{ \mathrm{i} \omega \int_0^t \left( e^{-\lambda u} y_0 + \int_0^{\lambda u} e^{v - \lambda u} \mathrm{d}Z_v \right) \mathrm{d}u \right\} \right]. \end{align*}](http://www.matthiasthul.com/wordpress/wp-content/ql-cache/quicklatex.com-f1fe8125d2daa3a8830cf1f5c77b850c_l3.png)

We now solve the first of the two integrals in the exponent and reverse the order of integration for the second to get

![Rendered by QuickLaTeX.com \[ \ldots = \mathbb{E} \left[ \left\{ \frac{\mathrm{i} \omega y_0}{\lambda} \left( 1 - e^{-\lambda t} \right) + \mathrm{i} \omega \int_0^{\lambda t} \int_{v / \lambda}^t e^{v - \lambda u} \mathrm{d}u \mathrm{d}Z_v \right\} \right]. \]](http://www.matthiasthul.com/wordpress/wp-content/ql-cache/quicklatex.com-924be313f63f00fdd2577a81e11fcdf0_l3.png)

Here, we carefully adjusted the limits such that the domain of integration stays unchanged. We now take the first non-random term outside the expectation and solve the inner integral to get

![]()

To evaluate the remaining expectation, let ![]() be a partition of the interval

be a partition of the interval ![]() . Then, not being fully rigorous, we get

. Then, not being fully rigorous, we get

![Rendered by QuickLaTeX.com \begin{align*} & \mathbb{E} \left[ \exp \left\{ \frac{\mathrm{i} \omega}{\lambda} \int_0^{\lambda t} \left( 1 - e^{v - \lambda t} \right) \mathrm{d}Z_v \right\} \right]\\ & = \lim_{\vert \vert \Pi \vert \vert \downarrow 0} \mathbb{E} \left[ \exp \left\{ \frac{\mathrm{i} \omega}{\lambda} \sum_{i = 1}^n \left( 1 - e^{t_{i - 1} - \lambda t} \right) \left( Z_{t_i} - Z_{t_{i - 1}} \right) \right\} \right]\\ & = \lim_{\vert \vert \Pi \vert \vert \downarrow 0} \prod_{i = 1}^n \mathbb{E} \left[ \exp \left\{ \frac{\mathrm{i} \omega}{\lambda} \left( 1 - e^{t_{i - 1} - \lambda t} \right) \left( Z_{t_i} - Z_{t_{i - 1}} \right) \right\} \right]. \end{align*}](http://www.matthiasthul.com/wordpress/wp-content/ql-cache/quicklatex.com-f52e30b24bee65c085a00b47e5856d9f_l3.png)

Here, we used that the increments of the Lévy process ![]() over non-overlapping time intervals,

over non-overlapping time intervals, ![]() , are pairwise independent. Now denote by

, are pairwise independent. Now denote by ![]() the characteristic exponent of the process

the characteristic exponent of the process ![]() , i.e. it is the logarithm of the characteristic function of

, i.e. it is the logarithm of the characteristic function of ![]()

![]()

For the moment, we are not concerned about the particular functional form that ![]() takes. Since

takes. Since ![]() is a Lévy process, it follows that the characteristic function

is a Lévy process, it follows that the characteristic function ![]() of

of ![]() can be expressed as

can be expressed as

![]()

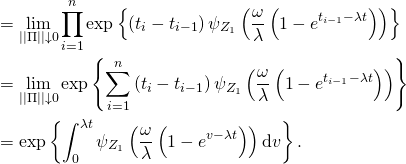

see e.g. Proposition 3.2 in Cont and Tankov (2004) or Theorem 1.3.3 in Applebaum (2004). Consequently, we can write the last expression as

See also Proposition 2.1 in Barndorff-Nielson (2001) and Cont and Tankov (2004) for similar results. By reversing the change of variables and setting ![]() , we finally obtain

, we finally obtain

![]()

Summary

In this post, we defined the general class of non-Gaussian Ornstein-Uhlenbeck processes that are driven by a subordinator Lévy process. Their characteristic function can be expressed in terms of the characteristic exponent of the background driving Lévy process. To find explicit expressions, we thus need to next impose assumptions on the characteristic triplet ![]() . This will be the topic of future posts.

. This will be the topic of future posts.

References

Applebaum, David (2004) Lévy Processes and Stochastic Calculus: Cambridge University Press

Barndorff-Nielsen, Ole E. (2001) “Superposition of Ornstein-Uhlenbeck Type Processes,” Theory of Probability and its Applications, Vol. 45, No. 2, pp. 175-194

Barndorff-Nielsen, Ole E. and Neil Shephard (2001a) “Modelling by Lévy Processes for Financial Econometrics,” in Ole E. Barndorff-Nielsen, Thomas Mikosch and, and Sidney I. Resnick eds. Lévy Processes – Theory and Applications: Birkhauser, pp. 283-318

———- (2001b) “Non-Gaussian Ornstein Uhlenbeck-based Models and some of their Uses in Financial Economics,” Journal of the Royal Statistical Society – Series B, Vol. 63, NO. 2, pp. 167-241.

Cont, Rama and Tankov, Peter (2004) Financial Modelling with Jump Processes: Chapman & Hall

Sato, Ken-iti (1999) Lévy Processes and infinitely divisible Distributions: Cambridge University Press